Download this Partnerize eBook for insight into five recommended strategies to set up your programs, and marketing team or agency, for maximum success.

From its roots in the affiliate marketing space, we are seeing the industry expand to encompass new sectors - arenas like influencer marketing, strategic brand-to-brand partnerships, channel agreements, and more. Marketers need to consider new strategies in order to drive more revenue and brand value from the channel.

Our top brands and agencies are employing custom commissioning strategies, creating strategic partnerships with other advertisers, and pulling deeper insights from their program data to optimize their affiliates and partnerships.

Download the eBook and learn how to:

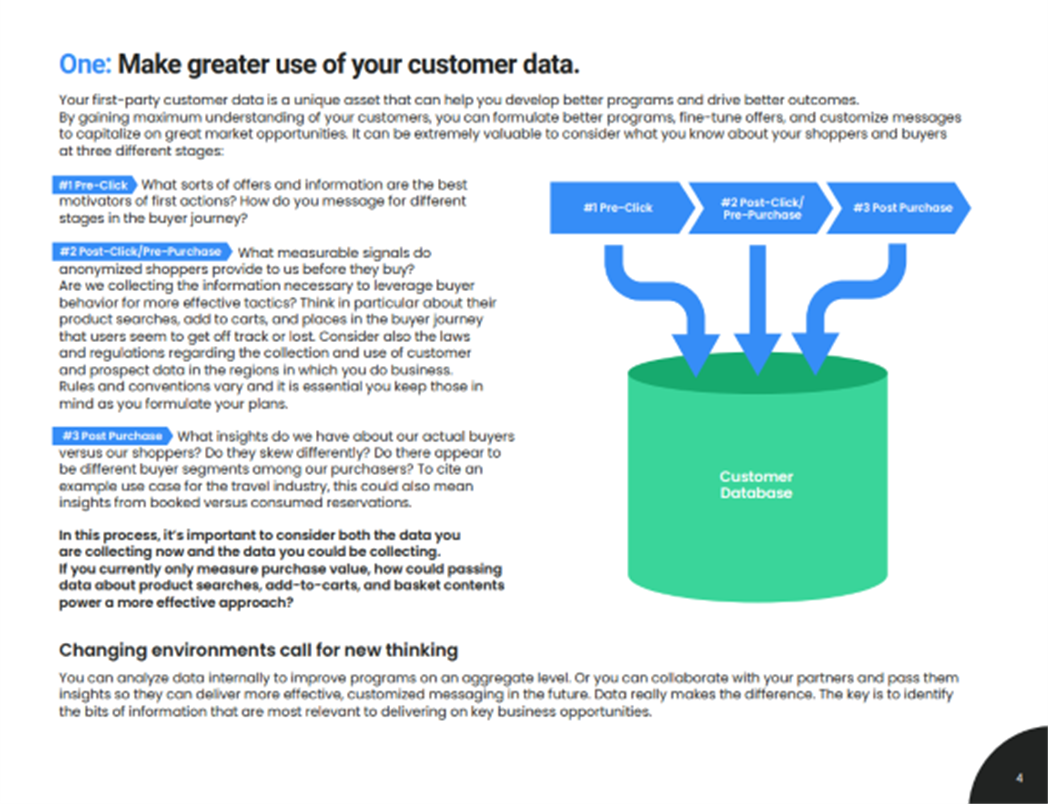

- Make Greater Use of Your Customer Data

- Understand and Leverage the Strengths of Your Leading Partners

- Explore Technological Solutions to Market Opportunities

- Watch Your Competitors. And Amazon.

- Identify and Pursue Top Tier Strategic Brand Partners

- Much more!