How big is the partnership growth opportunity for leading brands?

What are the trends for the partnership marketing market? Where is the industry headed? In our massive 2018 market research survey, we asked 1,200 senior brand leaders these and many other questions that reveal both the state and future of partnerships.

This partner marketing research reveals:

- How partnership marketing programs contribute to revenue and long-term success

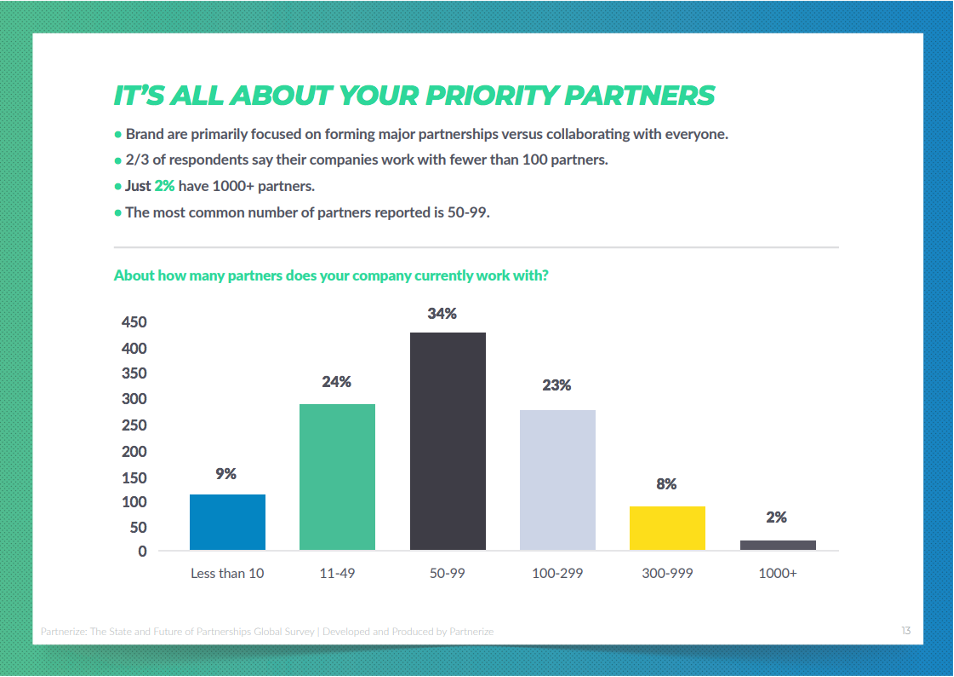

- How brands are defining their business partnership strategies

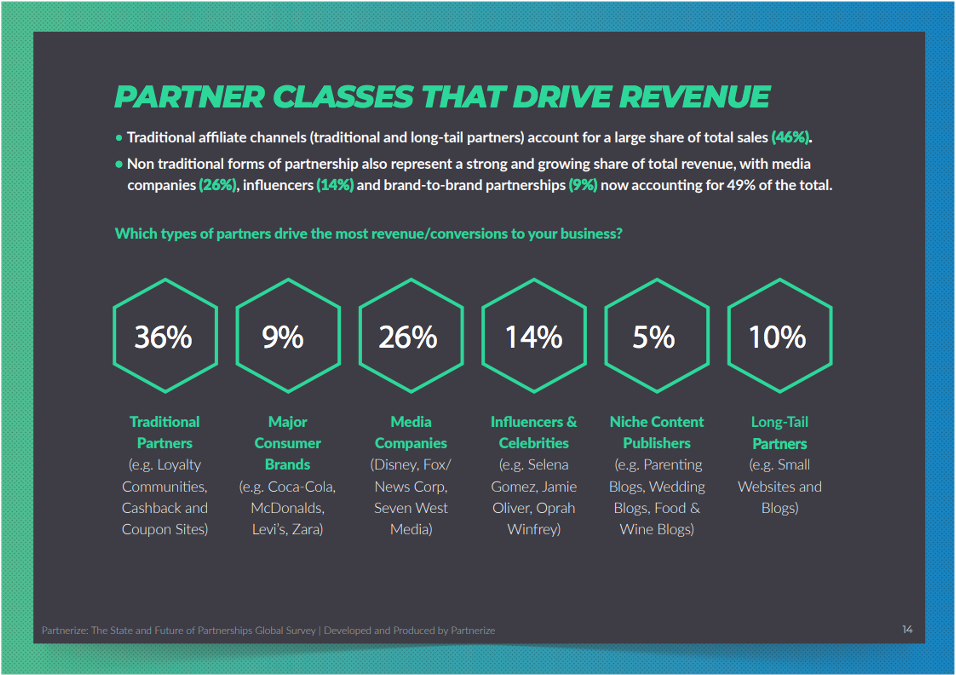

- Which categories of partners are driving the greatest revenue

- Where marketers are placing their bets to drive revenue growth

- How "affiliate marketing" relates to "partner marketing"

- Much more!

Download the groundbreaking data and marketing strategy insights available in The State and Future of Partnerships now!